TLDR:

- Meyer Burger Technology AG (VTX:MBTN) experienced a 24% loss last week affecting both individual investors (48% ownership) and institutions.

- 47% of the business is held by the top 25 shareholders, while institutions hold 42% of Meyer Burger Technology.

In a recent analysis, it was revealed that retail investors own a significant portion of Meyer Burger Technology AG, influencing key decisions within the company. Despite a 24% loss last week, both individual investors and institutions felt the impact. Retail investors, holding 48% of the company, have the most to gain or lose in terms of upside potential or downside risk. Institutions, on the other hand, were not immune to the market cap drop of CHF94m.

Key Insights:

Meyer Burger Technology AG, a technology company, produces and sells solar cells and modules. The ownership breakdown shows a significant influence of retail investors and institutions, while hedge funds have minimal shares in the company. Sentis Capital PCC stands as the largest shareholder with 10% of shares outstanding. Insider ownership is under 1%, with the general public holding a 48% stake in the company.

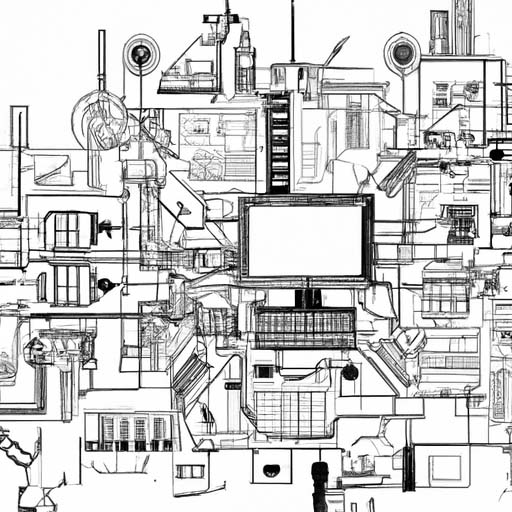

Ownership Breakdown:

Meyer Burger Technology AG is held by a mix of retail investors, institutions, and private companies. While institutions often bring credibility to a stock, their crowded trades can pose risks. Analyst sentiments and insider ownership play a role in painting a full picture of the company’s future performance. The general public’s stake and private company ownership also contribute to the overall ownership structure of Meyer Burger Technology AG.

Next Steps:

While understanding ownership is crucial, other factors such as analyst predictions and insider transactions should also be considered. The analysis suggests 1 warning sign in terms of investment in Meyer Burger Technology, urging further research into the company’s valuation and future prospects.