As the tax season approaches, the thought of navigating through numerous forms, calculations, and deadlines can be quite daunting for individuals and businesses alike. However, thanks to advancements in technology, there is now a glimmer of hope for those seeking a simplified tax process.

Enter automation – a powerful tool that can revolutionize the way we approach taxation. In this article, we will explore the various automated tools available today that are easing tax processes for individuals and businesses. From streamlining data entry to minimizing errors and maximizing efficiency, these tools are transforming the tax landscape.

Automated Data Entry: Time-saving and Efficient

Gone are the days of painstakingly inputting numbers and figures into tax forms manually. With the advent of automated data entry tools, individuals and businesses can save valuable time and effort. These tools utilize optical character recognition (OCR) technology to extract data from invoices, receipts, and other financial documents. By simply scanning or uploading these documents, the software can automatically populate the relevant tax forms, eliminating the need for manual data entry. This not only speeds up the process but also reduces the chances of errors and discrepancies.

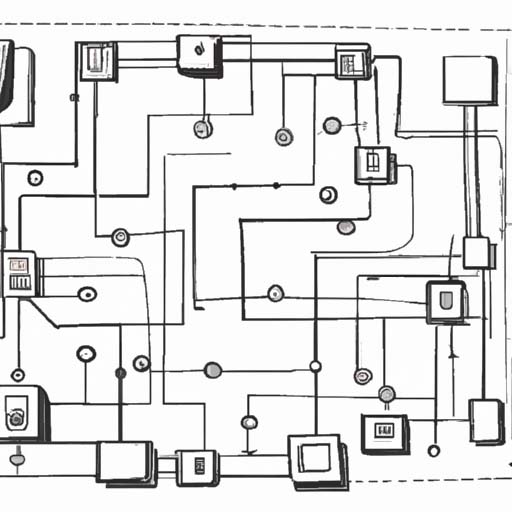

Seamless Integration: Software Integration for a Smooth Experience

Another key advantage of automation in taxation is the seamless integration of various software and platforms. Whether it’s connecting your accounting software with tax preparation software or linking financial institutions for direct importing of transactions, automation allows for a streamlined and hassle-free experience. Instead of juggling multiple systems and manually transferring information, these integrated tools enable data to flow seamlessly between different platforms. This not only simplifies the tax process but also ensures accuracy and consistency of information.

Smart Data Analytics: Maximizing Deductions and Minimizing Risks

Automation not only simplifies data entry and integration but also empowers individuals and businesses to make more informed decisions when it comes to deductions and compliance. Smart data analytics tools utilize algorithms to analyze financial data and identify potential deductions, credits, and exemptions that may have been overlooked manually. These tools can provide valuable insights and recommendations, helping taxpayers optimize their tax savings while reducing the risk of audits or penalties.

Streamlined Filing and Payments: Effortless Submission and Remittance

When it finally comes time to file your taxes and make payments, automation can once again come to the rescue. Online tax filing software allows individuals and businesses to submit their returns electronically, eliminating the need for physical paperwork and reducing the risk of errors. Moreover, many automation tools offer integration with payment processors, enabling seamless remittance of tax liabilities. By simplifying the filing and payment process, automation ensures compliance and peace of mind.

In conclusion, automation has revolutionized the way individuals and businesses approach taxation. From automated data entry to seamless integration of software, smart data analytics to streamlined filing and payments, these tools offer a range of benefits that simplify tax processes. By reducing manual work, minimizing errors, and providing valuable insights, automation not only saves time and effort but also increases efficiency and accuracy. As tax season approaches, embracing automation can be a game-changer in easing the stress and complexity associated with taxation. So, why not leverage the power of automation and take your tax processes to the next level?