TLDR:

Key Points:

– Credit unions face challenges such as regulatory changes, member expectations, and technological advancements.

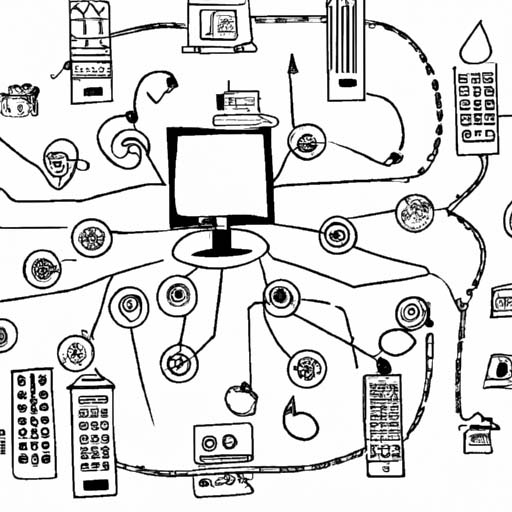

– Data-driven decision-making and technology implementation are essential for credit union success.

Devesh Khare, Chief Product Officer of MeridianLink, discusses how credit unions can navigate 2024 with data and technology. He highlights the evolving member expectations driven by technological innovation and the importance of offering seamless, personalized financial services. Khare emphasizes the need for credit unions to focus on areas such as credit risk, fraud mitigation, and anticipating payment challenges to attract and retain members. He also stresses the importance of investing in superior customer service and preparing members for the future by enhancing digital literacy and cybersecurity education. Using technology, credit unions can offer tailored solutions to individual members and enhance consumer loyalty. Khare concludes that understanding member lifestyles, life events, and unique financial situations is crucial for providing better advice and becoming a strong financial partner.