AMLYZE and TransactionLink have announced a strategic partnership to transform anti-money laundering (AML) and know your customer (KYC) automation. TransactionLink’s no-code platform allows companies to create custom onboarding processes and streamline their AML/KYC efforts. AMLYZE, a leading RegTech company specializing in anti-financial crime solutions, will handle most stages of the AML journey for TransactionLink’s clients. This collaboration aims to provide businesses with a user-centric and efficient approach to managing regulatory compliance.

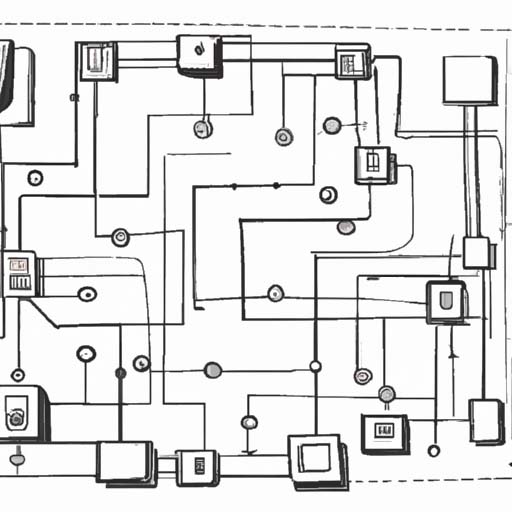

AMLYZE offers a comprehensive suite of solutions, including real-time and retrospective transaction monitoring, client risk scoring, AML/CFT investigation, and screening for PEP, sanctions, and adverse media. TransactionLink’s drag-and-drop builder simplifies compliance by allowing companies to design their own onboarding processes tailored to their specific needs. The partnership between AMLYZE and TransactionLink combines AMLYZE’s expertise in RegTech with TransactionLink’s innovative platform to deliver a robust and user-friendly AML/KYC automation solution.